I know, I know — you’re PAINTERS. Why should you waste your time doing your workers’ comp audit?

Well, for starters, as business owners, I’m sure you all know not to blindly trust what anyone tells you. If you did, you wouldn’t have gotten where you are.

So why should you trust an auditor?

Don’t get me wrong: auditors aren’t out to get you. (Really, they aren’t — it would take too much effort!)

BUT that doesn’t mean they:

- always know what they’re doing

- don’t make honest mistakes

So I’m here to encourage you to arm yourself with knowledge and have a REALLY GOOD idea of what your insurance premium for the year should be. Because if the auditor’s numbers deviate a lot from yours, you have grounds to call him out on it.

Not only will you potentially catch a mistake, you’ll save yourself a ton of grief in not having to dispute the audit later.

1. Print a payroll report

Print a payroll report with the date range matching your policy period excluding the last day. So if your policy period is

7/1/11 – 7/1/12

print a report for

7/1/11 – 6/30/12 (which is 12 months exactly)

Keep in mind that if your policy starts mid-month, the auditor will likely move the audit period to the 1st of the same month or the following month, whichever is closer.

In other words:

Policy period = 7/5/11 – 7/5/12 –> Audit period = 7/1/11 – 7/1/12

Policy period = 7/20/11 – 7/20/12 –> Audit period = 8/1/11 – 8/1/12

Now that we’ve taken care of the technical stuff… 🙂

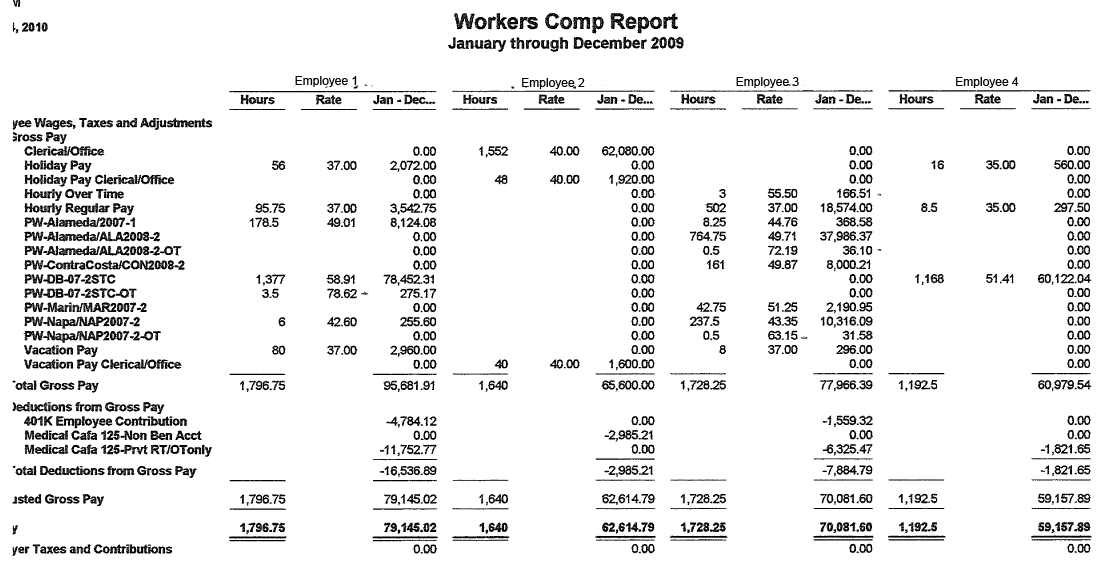

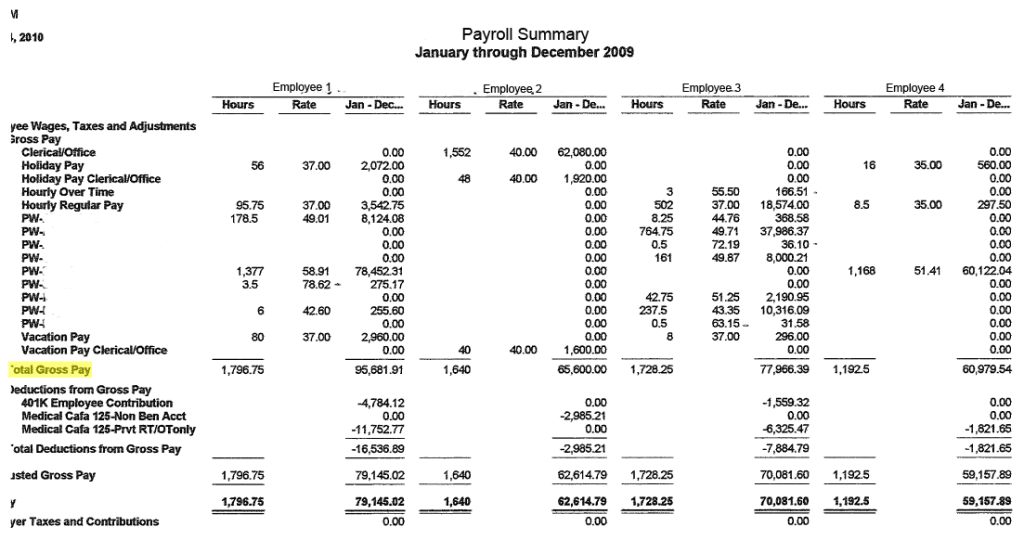

Here’s an example of a QuickBooks report. See how the date range covers the entire 12 months.

2. Assign class codes to your employees

Definition time:

Workers’ comp classification codes are 4-digit codes, each with its own premium rate, that your insurance carrier uses to calculate the premiums you owe every year.

Class codes are assigned to each employee based on their job duties. For example, in most states, the class code for a painter is 5474. For a clerical office employee, the code is 8810.

Getting the class codes correct is essential to accurately estimating your premiums, so make sure you review the classification descriptions first.

Then assign a class code to all of your employees. And I mean, every single employee who worked during the audit period in question. Many employers conveniently forget about those dozen or so employees who worked a few weeks here, a few weeks there. The audit will pick up ALL of them.

3. Add up TOTAL GROSS PAY for each class code

The auditor will always account for total gross pay first before subtracting out any adjustments. This way, he doesn’t miss anything. (Yes, we auditors are thorough like that!)

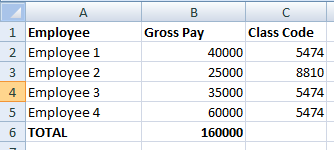

The easiest way to do this step is to list out your employees on a spreadsheet with their gross pay and class code.

Like this:

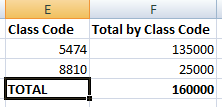

Then summarize the gross pay by class code, like this:

At this point, if your head hurts, you can call it a day

At least you know approximately how much payroll exposure you have for each code. If you have adjustments like overtime premium, you can be sure that the auditor will subtract those out.

Which means that the auditor’s final numbers should be LOWER than yours.

And absolutely do not forget…

…subcontractor certificates of insurance. If you have hired ANYONE or ANY COMPANY during the period, having their certs will prove that they have their own workers’ comp coverage.

Because the last thing you want to discover on your audit is that you’re going to be paying to cover that janitorial contractor you hired.

Finally, do not let the auditor leave

without going over the audit with him. That means you MUST be satisfied with — or at least understand how — he arrived at his figures. Once the audit is processed, you will be chasing your tail for the next few months to dispute any mistakes that slipped through.

That wasn’t so difficult, was it?

I’ll admit, crunching numbers like this may not be your idea of a party, but doing this will save you a lot of time later on.

And if you truly don’t want to tackle this, well…that’s what accountants are for, right?

If you have ANY questions, ask them in the comments section below! Or check out my site, www.WorkersCompClassCodes.com, for more tips and tricks on how to get through your audits painlessly.

Good one Elaine. The numbers matter to ‘painters’ who are smart. Success comes from knowing and using your numbers – whether a one person painter business or a larger, more established company operating a painting contracting business. Knowing and managing by the numbers: costs, production, marketing/communications and sales leads vs. closings and margins, is not an option.

Brandt, I totally agree. A business owner can’t afford NOT to be knowledgeable about numbers and why something works or doesn’t work. And I know in your particular area this is extremely important!

Thanks for your comment!

Elaine

Im paying $400 a week for for workers comp and it is a huge part of my business expenses. I’d rather be painting, but as you stated, I’m also a business owner. I usually don’t spend much time on the audit but your number examples have opened my eyes and I will pay more attention from now on. It’s not what you make it’s what you keep right?